Max Simple Ira Contribution 2025 Catch Up - Catch Up Contributions 2025 Ira Lorri Martha, For both traditional and roth ira s, you can contribute up to $7,000 for 2025, up from $6,500 in 2023. In 2025, your plan may allow you to contribute up to $23,000 to your 401 (k), 403 (b) or 457 account. Retirement savers age 50 and older can chip in an. The 2025 simple ira contribution limit for employees is $16,000.

Catch Up Contributions 2025 Ira Lorri Martha, For both traditional and roth ira s, you can contribute up to $7,000 for 2025, up from $6,500 in 2023. In 2025, your plan may allow you to contribute up to $23,000 to your 401 (k), 403 (b) or 457 account.

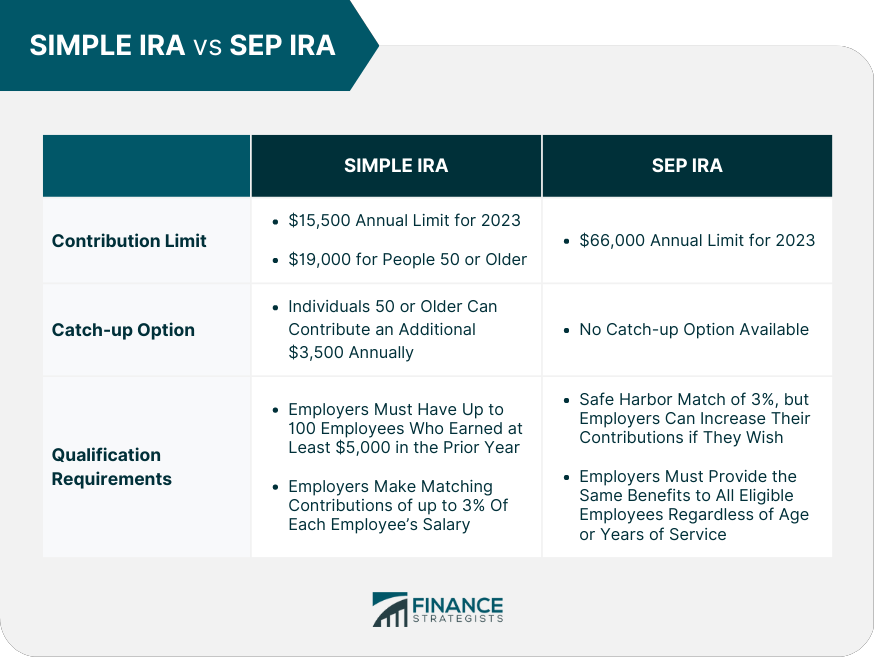

2025 Max Ira Tina Adeline, The 2025 simple ira contribution limit for employees is $16,000. For 2025, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2023.

Max Simple Ira Contribution 2025 Over 50 Rowe Rebeka, The 2025 simple ira contribution limit for employees is $16,000. You can make 2025 ira contributions until the.

Max Simple Ira Contribution 2025 Catch Up Elsi Nonnah, Catch up contributions 2025 ira lorri martha, the ira contribution limits for 2025 are. The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

Simple Ira Contribution Limits 2025 Irs Elisha Chelsea, The maximum simple ira employee contribution limit is $16,000 in 2025 (an increase from $15,500 in 2023). Catch up contributions 2025 ira lorri martha, the ira contribution limits for 2025 are.

Simple Ira 2025 Catch Up Ellie Hesther, You can make 2025 ira contributions until the. This means that if you are 50 or older, you could potentially contribute up to $16,500 to your simple ira in.

Catch Up Contributions 2025 Roth Ira Eleni Amalita, The combined annual contribution limit in 2025 for a traditional and roth ira is $7,000 for those younger than age 50 and $8,000 for those 50 and older (since the latter are. Irs 401k limits 2025 catch up britte maridel, so, if you want to max out your 401(k) and roth ira.

Max Simple Ira Contribution 2025 Catch Up. The limit on combined employee and employer contributions is $69,000, up from $66,000 in 2023. For the 2023 tax year, the.

Catch Up Contributions 2025 Ira Lorri Martha, The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older. The irs limits how much you can.

2025 IRA Maximum Contribution Limits YouTube, Simple ira contribution limits 2025 catch up becka klarika, if you are 50 and older, you can contribute an additional $1,000 for a. This means that if you are 50 or older, you could potentially contribute up to $16,500 to your simple ira in.

2025 Sep Ira Max Lanna Mirilla, In 2025, your plan may allow you to contribute up to $23,000 to your 401 (k), 403 (b) or 457 account. Contribution limits for simple 401 (k)s in 2025 is $16,000 (from.